Web-based GST billing software for small business enterprises

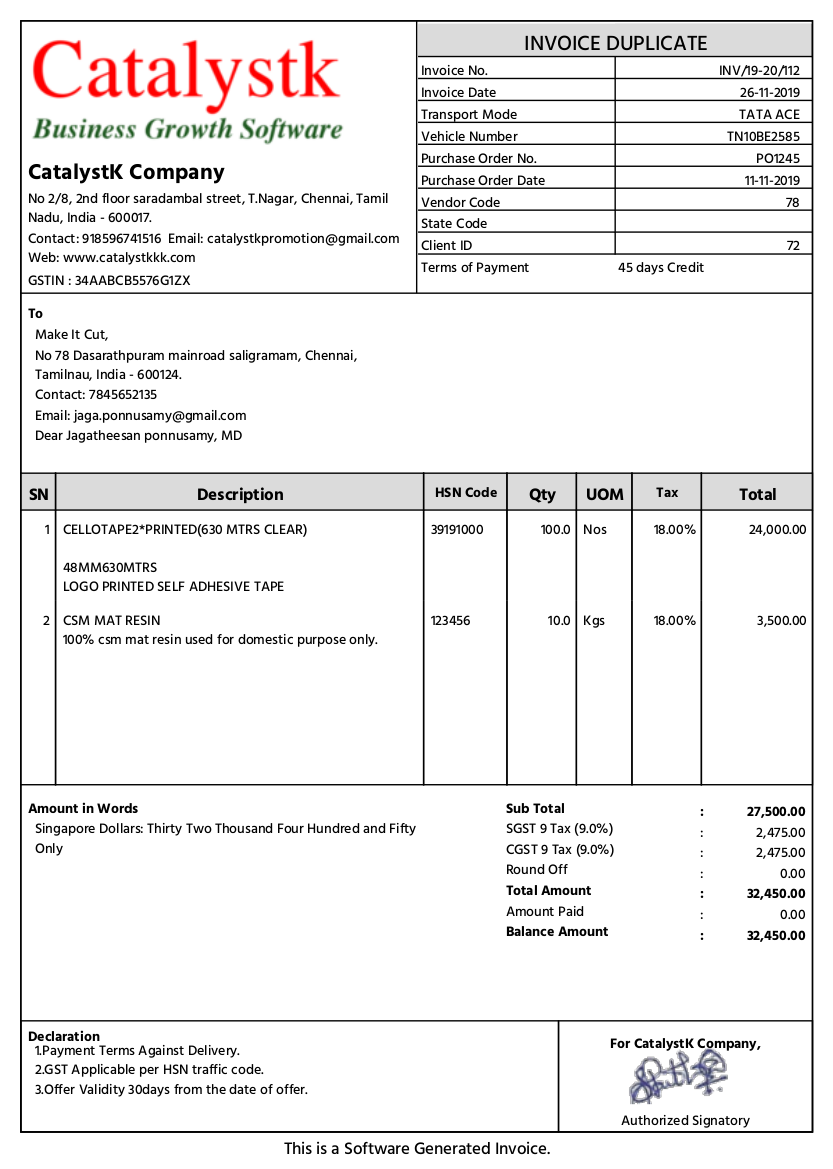

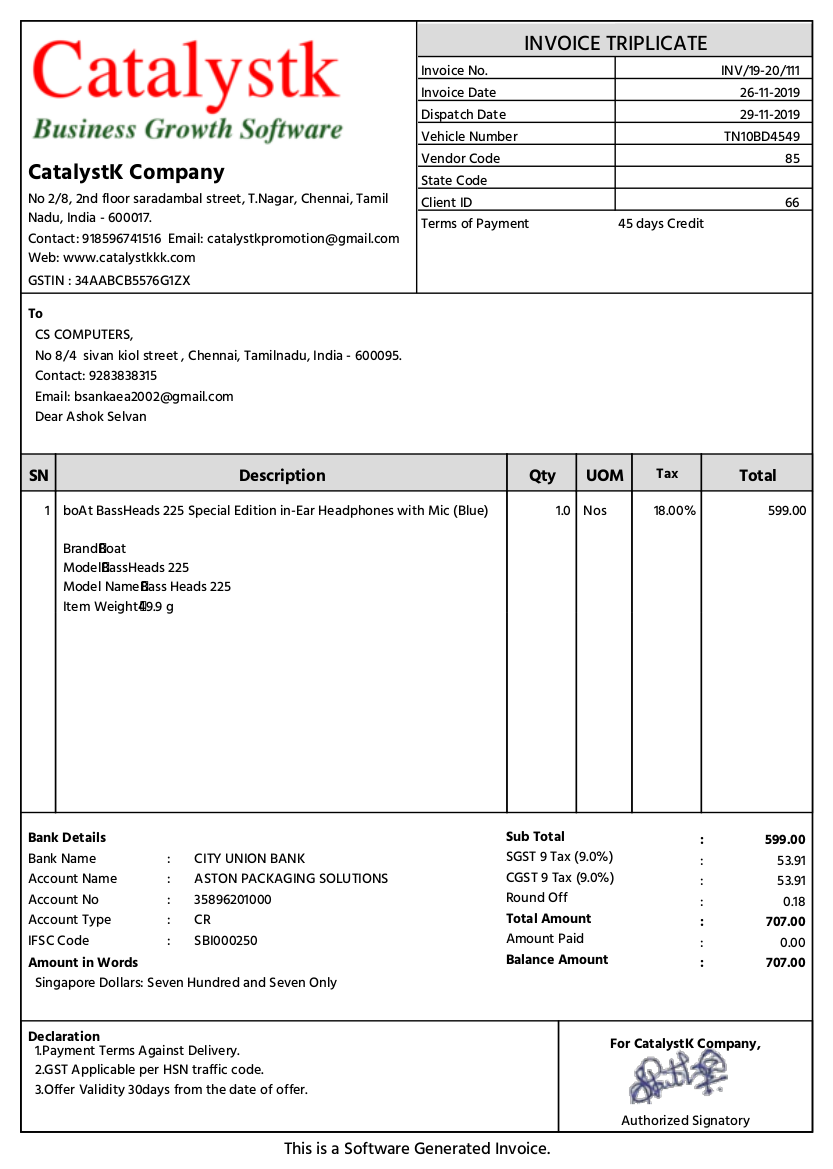

A web-based GST billing software provides the best solution for business entrepreneurs to enhance the invoicing process. With the world becoming digital day by day, a web-based billing system serves as the best platform for all businesses. Catalystk offers one such cloud-based GST billing software for small businesses to simplify the billing process, automate workflows and share professional, accurate bills or GST invoices with their customers. Using the online GST billing software, a full-fledged GST compliant invoice can be generated within seconds with the vendor details, customer details, GSTIN, products or services provided, tax rates, business terms, and other business-related information. Catalystk web-based GST billing software for small businesses is integrated with Lifetime free GST billing software, free CRM software, ERP software, AMC or Rental software, Inventory software, Manufacturing software, Artificial Intelligence ( AI ), and 500+reports. It's fully free with all the options. Click the link to register for free.

Catalystk provides cloud GST billing software with options to manage inventory, sales orders, and email GST invoices in multiple formats.

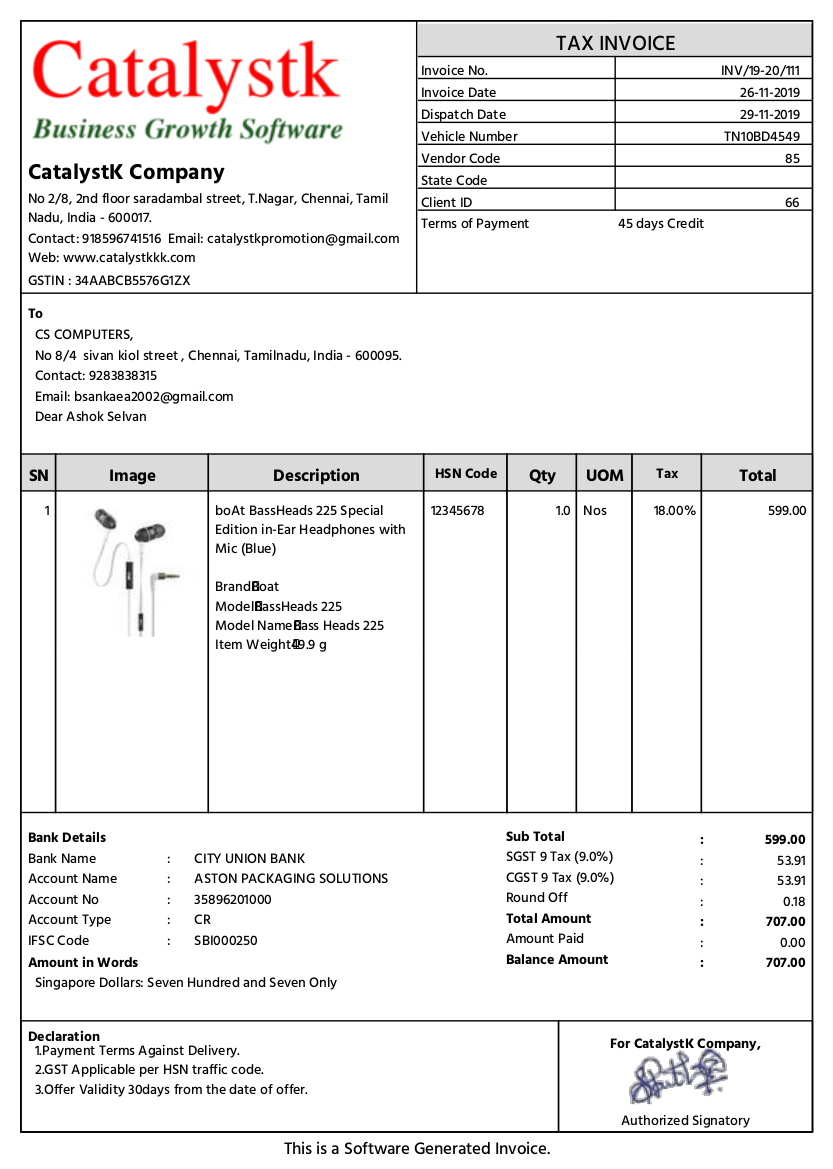

Catalystk offers one of the best GST billing software in India integrated with business growth tools. Using the system you can streamline all customer requirements, sales orders, goods delivery, and manage inventory efficiently. The software supports remote working, provides easy data access to create tax invoices in less time while maintaining accuracy. GST invoices can be created with the product description, prices, tax rates, discounts, billing address, shipping address, dispatch details, payment terms, and images as well. GST invoice pdf can be retrieved or shared with customers via print, download, mail option straight away using the application.

Steps to generate a tax invoice using Catalystk billing software:

- Click the side menu option of "Home" and in the "Sales" tab, click the "Invoice" option.

- Click "New Invoice" -> Enter the customer, product details with price, tax percent -> Click "Save" to generate a tax invoice.

- Click the "Download" option to retrieve GST invoice pdf format.

- Use the "Print", and "Mail" options to share tax invoices with the customer.

Free GST billing software features:

- Invoice with tax

- GST Calculations

- Pending payments

- Automated Sales Order, Invoice mailing system

- Finance management

- General Ledger

- Client Ledger

- Supplier Ledger

- Pending Payments

- Balance Sheet

- Profit and Loss

- Excel Uploads

- Excel Download

- Estimation with images

- Estimation grouping products

- Sales management

- Procurement Management

- Purchase Enquiry

- Vendor Identification

- Purchase Order

- Goods Received Note

- Goods Return

- Purchase Invoice Verification

- Purchase Invoice

- Pending Purchase

- Estimation without image

- Revised Quotation

- Email Quotation

- SMS Quotation

- Quotation Follow-ups

- missed quotation follow-ups

- Proforma Invoice

- Sales Order

- DC

- Sales Projections

- Sales achievements

- Deals management

- Task management

- Leads management

- Return Received

- HSN Code

- Sales Work Flow

- Manufacturing

- Bill of Materials

- MRP(Planning)

- Job Work / Job Order

- Work Order

- Manufacturing process

- Grouping

- Follow Up

- Reports

Catalystk online billing software with GST provides features to record customer payments, ledgers, and other financial transactions.

Catalystk online invoice software with GST also simplifies invoice tracking and clearing invoice payments efficiently. The invoice template provides options to record payments or transactions against each invoice. The system also lets you add payment reminders to track pending amounts and overdue invoices. All sales transactions, ledgers, receipts, expenses, and other financial transactions can be recorded and managed efficiently using the finance module. The reporting module produces monthly invoice reports for GST filling along with other useful reports such as product sales reports, profit margin reports, high-selling product reports, and many more.