GST invoice software for small business enterprises in India.

The introduction of Goods and Service Tax (GST) in India has made it essential for businesses to generate and issue GST compliant bills. With such a scenario, manual or paper-based billing might result in inaccurate billing ad does not provide an ideal solution. Catalystk offers GST billing software for all small-scale organizations and growing businesses to create professional-looking invoices with GST. The invoice software with a user-friendly interface and template helps you generate, print, and share invoices with automated tax calculations and monthly reports of the same. It is a business growth software platform that streamlines invoice creation and tracking, thus providing a fully automated sales management solution. Invoices can be created and shared with all the required business details, GSTIN, product description, and prices and the tax levied on products. Also, the software is embedded with enhanced tools that provide you quick data access thereby accelerating the billing process and improving sales functionality. Catalystk GST invoice software is an integration of free CRM software, ERP software, AMC or Rental software, Inventory software, Manufacturing software, Artificial Intelligence ( AI ), and 500+reports. It's fully free with all the options. Click the link to register for free.

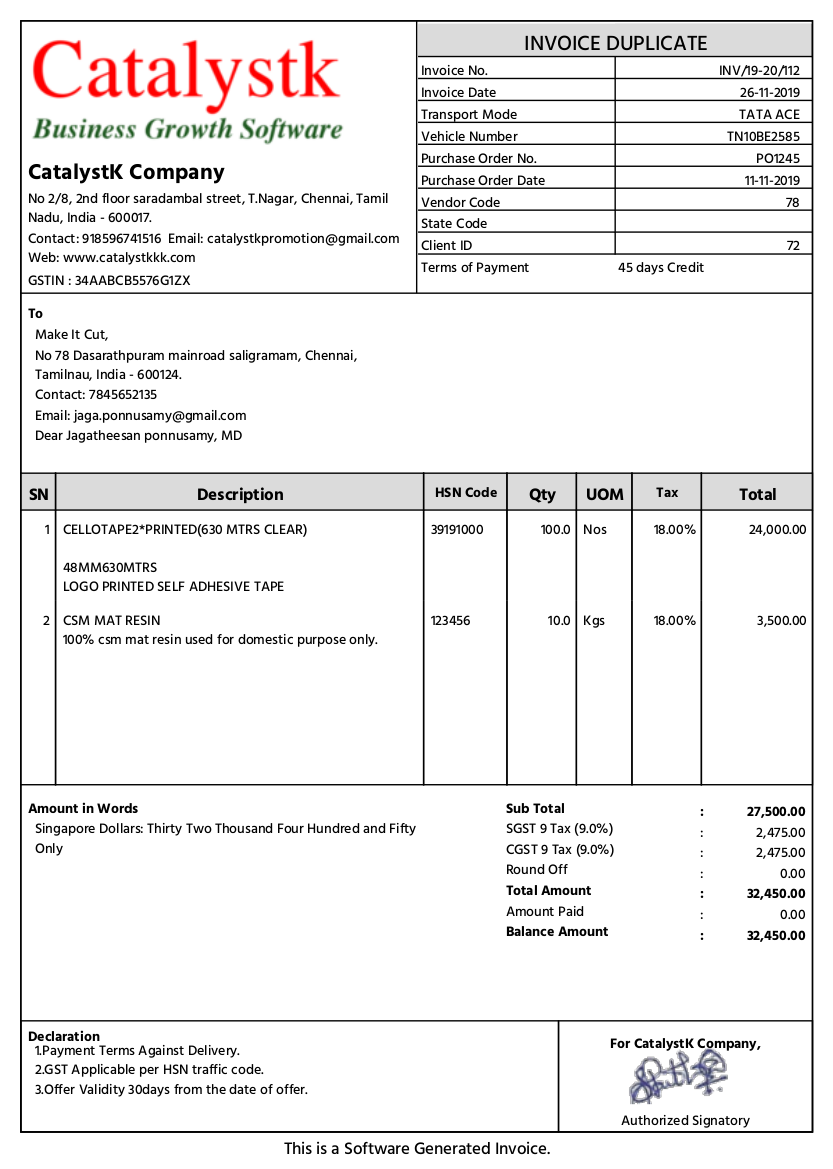

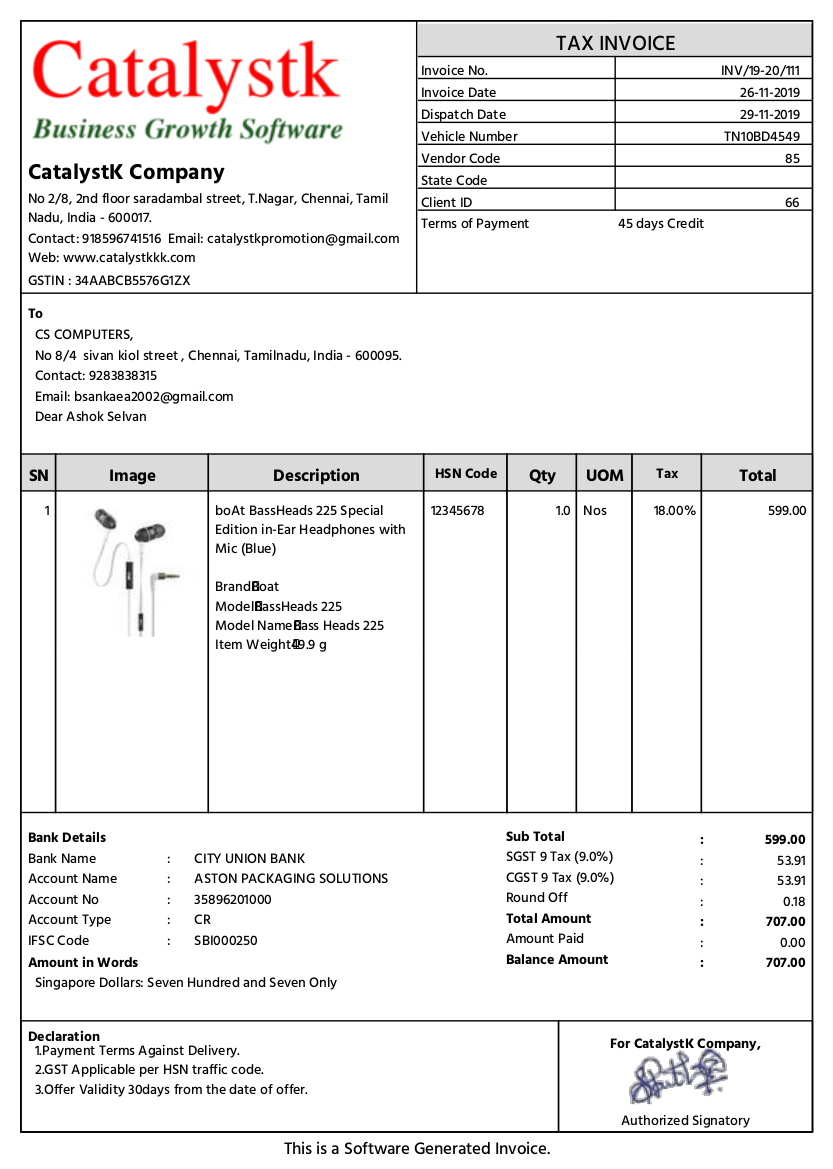

Catalystk GST invoicing software lets you print invoices with images, business letterhead and share invoices using the built-in mail template.

The invoice software with GST is embedded with a built-in invoice and mail template to share print GST bills in multiple formats. Invoices can be generated with product images, headers, footers, business letterhead, logo, and authorized signatory details. The software allows quick changes and you can print customized invoices with new prices, discounts, notes, custom invoice number format, payment terms, billing, and shipping address, and other additional data. Businesses can straight away share the tax invoice PDF with clients using the built-in invoice email template.

Steps to generate and share GST invoices using billing software:

- Click the side menu option of "Home" and in the "Sales" tab, click the "Invoice" option.

- Click "New Invoice" -> Enter the customer, product details with price, tax percent -> Click "Save" to generate a tax invoice.

- Click the "Download" option to retrieve the GST invoice format.

- Use the "Print", and "Mail" options to share tax invoices with the customer.

GST billing software features:

- Invoice with tax

- GST Calculations

- Pending payments

- Automated Sales Order, Invoice mailing system

- Finance management

- General Ledger

- Client Ledger

- Supplier Ledger

- Profit and Loss

- Excel Uploads

- Excel Download

- Quotation with images

- Quotation grouping products

- Sales management

- Procurement Management

- Purchase Enquiry

- Vendor Identification

- Purchase Order

- Goods Received Note

- Goods Return

- Purchase Invoice

- Pending Purchase

- Revised Quotation

- Email Quotation

- Quotation Follow-ups

- Missed quotation follow-ups

- Proforma Invoice

- Sales Order

- DC

- Sales Projections

- Sales achievements

- Deals management

- Task management

- Leads management

- Return Received

- Sales Work Flow

- Reports

Catalystk online invoice software simplifies invoice tracking and lets you manage sales transactions, ledgers with accurate invoice reports.

Catalystk provides GST billing software in India for businesses to completely systemize the billing and sales workflow. Using the invoice software platform enterprises can quickly issue bills, monitor the invoice payments, and manage all sales transactions efficiently. With the software's enhanced tools it becomes easy to manage customer ledgers, accounts, track pending payments, client-wise outstanding amounts, generate vouchers and manage expenses. The billing software's reporting tool produces client reports, daily, weekly, monthly, and yearly invoice reports with tax payable amounts, profit margins, and product-wise sales reports with an excel download option. Also, the integration of the billing software with other tools such as quoting, order management, and inventory management automates the core business process.